Xiaomi 4.8 billion yuan or confiscated ,why India has become a "graveyard of foreign companies"?

According to foreign media reports, the Indian Law Enforcement Agency issued a formal notice to Xiaomi's branches in India, some executives and relevant banks on the 9th, accusing them of illegally transferring funds abroad and allegedly violating India's Foreign Exchange Management Act. This charge means that Xiaomi was frozen by India last year 4.8 billion yuan is likely to be officially forfeited, which is also the largest amount of funds confiscated since the establishment of the Indian government.

Ten years in vain

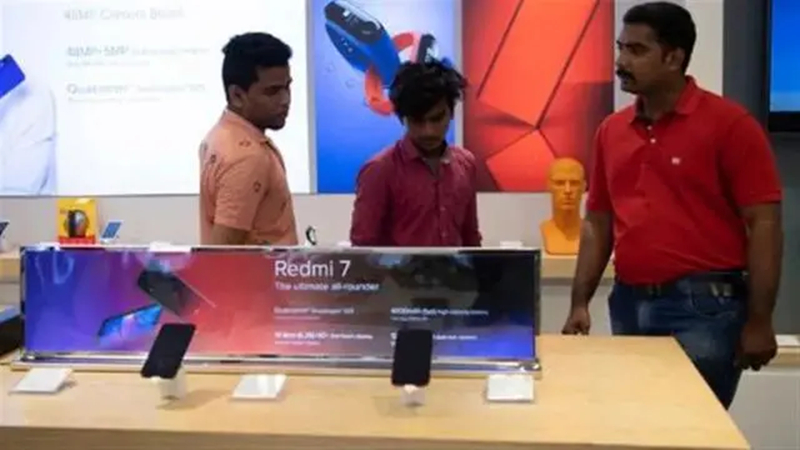

In 2014, Indian Prime Minister Narendra Modi proposed the national strategy of "Make in India" (Make in India). Unlike Made in India, the new strategy encourages foreign companies to invest and produce in India, rather than simply exporting domestic products. Taking advantage of this wind, Xiaomi officially entered India. After 10 years of development, Xiaomi has built seven factories in India, creating more than 20,000 jobs and a market share as high as 30% at one point.

Seemingly smooth development, but in 2022 ushered in the head of the stick. Xiaomi India was first accused of tax evasion by the Indian Ministry of Finance in January and fined 558 million yuan, and in April the Indian law enforcement agency froze 4.8 billion yuan of Xiaomi's funds on the grounds that Xiaomi had been illegally sending money to foreign entities in the name of "royalties" since 2015.

At first, Xiaomi was optimistic about the situation, arguing that it "strictly complies with local laws and regulations in all its operations, that the payment of royalties is a legitimate business arrangement, and that it will work closely with government authorities and clarify any misunderstandings", while filing a lawsuit in the Indian High Court. But in April this year, the Indian court rejected Xiaomi's complaint, and recently the Indian Law Enforcement Agency issued a formal notice of charges.

You know, Xiaomi's annual profit in India at its peak is less than 500 million yuan, if this 4.8 billion yuan fine finally landed, the equivalent of Xiaomi in India for 10 years for nothing.

Withdrawal from India

Xiaomi's encounter is not an isolated case. "India make money India spend, a respectively want to bring home." This joke tells the sorrows and helplessness of many multinational enterprises in India. 2022 July, the Indian government said OPPO in the import of cell phone parts when the wrong use of tariff exemptions, requiring it to recover taxes 3.7 billion yuan; and suspected of violating the "Prevention of Money Laundering Act" as the reason, freezing the 119 bank accounts of Vivo in India, requiring it to provide 800 million yuan as a guarantee to unfreeze.

Earlier, in 2009, IBM was recovered $860 million in taxes; in 2013, Nokia closed its Indian factory outright because of $360 million in back taxes; and in 2014, South Korea's Samsung was fined $200 million in taxes.

As a result, more and more Indian foreign companies choose to flee. 2020, in India annual sales of less than 3,000 Harley Motorcycle announced its withdrawal; 2021, the cumulative loss of $2 billion in India, Ford Motor also closed part of the manufacturing business; 2022, Glory cell phone team to withdraw from India; 2023, had suffered Indian workers "smash and grab "In 2023, Wistron, the Apple foundry, announced its complete withdrawal from the Indian market. Government officials said that as of July 2022, 5,079 multinational companies registered in India, 1,777 have "run away".

Enigmatic operation

In 2022, India's GDP will total nearly $3.4 trillion, and by mid-2023, India's population will reach 1.428 billion, making it the world's fifth largest economy and the most populous country in the world. The steady growth of economy and population, solid labor base and strong market demand should be the favorable factors for India to attract foreign investment. But the Indian government's series of "enigmatic operations" make people sweat.

The first is the most complex tax system in the world. Different parts of India and different departments often have different interpretations of taxation. As a result, tax recovery has become a common occurrence.

The second is the high level of policy uncertainty and discontinuity. In the initial stage of attracting foreign investment, the Indian government often offers a series of preferential terms, and then after the multinational enterprises have stabilized their presence, they may harvest profits and impose various restrictions by increasing tariffs and other means.

Finally, there is excessive national protectionism. On June 13, shortly after formal charges were issued against Xiaomi, the Indian government demanded that the CEO, CFO, COO and other executives of Chinese smartphone makers "be Indian" and that local companies be involved in the production process and local distributors in the export process.

If the Indian government can not face the above problems, and can not really improve the business environment, which companies dare to "make in India".

Article material source from the Internet, infringement please contact to delete.